When taxpayers are facing tax debt, many turn to tax return services to find a knowledgeable professional to help guide them through the process. The tax return services providers in Eastern Australia are unique in their experience, knowledge, and in the quality of the tax return preparation that they can provide. Taxpayers in Australia, RT Taxation is recognized that only a one-size-fits-all approach will not minimize or maximize the amount of their tax liability or maximize what they legally owe to the government! In fact, the tax liability can be maximized by providing the Australian Taxation Office with a detailed examination of every taxpayer’s financial circumstance, thereby allowing the agency to maximize its collection of tax liability.

If you have been negligent about paying your income taxes, the Internal Revenue Service has remedies to collect these delinquent amounts. In some cases, the Tax Authority will pursue you through Tax Court, while in others it will negotiate with you. If you choose the latter course, you want to ensure you are properly represented by an experienced tax return services business in Eastern Australia. Taxpayers in Australia know that selecting a reputable tax services business can maximize their recovery of delinquent taxes, while Eastern Australia tax professionals can utilize their experience and knowledge to negotiate with the ATO in such a way as to obtain the best possible resolution for their client.

Why Do You Need to Hire a Good Tax Return Services Provider?

Trained Tax Professionals

The tax returns filed by taxpayers in Eastern Australia are prepared by highly trained tax preparation service workers. These tax preparation workers prepare federal tax returns, state tax returns, and provincial tax returns as well. In addition, these workers prepare payroll tax deposits and aid with filing federal tax returns. There is no question that if you work with a tax preparation service that is based in Eastern Australia, you can rest assured that you will be receiving only the highest level of professional tax advice and service.

Follow Complete Tax Code

Taxpayers should never attempt to prepare their own tax returns. The tax laws are very complex and there is no better way to receive legal help in resolving tax issues than through an experienced tax return services business. If an individual taxpayer is unable to follow the complex tax code, they can become subject to penalty fines. In addition, improperly filed tax returns can result in interest and penalties being added to the balance of the taxpayer’s liability. Even in cases where a penalty is not incurred, a delayed payment could result.

Resolve Tax Return Problems

If a taxpayer is not able to resolve their tax return problems with the ATO, there is even more potential for the tax burden to increase. The tax collection process is typically very efficient, but errors do occur. Errors can occur when a taxpayer does not understand the complex tax code, they are attempting to include too many items on their return, or they miss a deadline. In cases where taxpayers are not properly represented, the tax burdens can be significantly increased. This represents a waste of time and money for both the taxpayer and the ATO.

Networking Skills

Individuals that perform tax return services for a living are often integral members of the community. They interact with local merchants, vendors, law enforcement, the media, and more. Individuals that work in the tax return industry have strong networking skills and can often make a significant contribution to any community. For this reason, they are great additions to any civic group and are very popular amongst members.

Use of Tax Software

Individuals that utilize the tax software may also be involved in a volunteer position. Many times, these individuals are active in local community groups and have developed relationships that could lead to future employment opportunities. In some tax filing situations, the service provider may also be able to work as an organizer or consultant.

Where to Get the Best Tax Return Services in Australia?

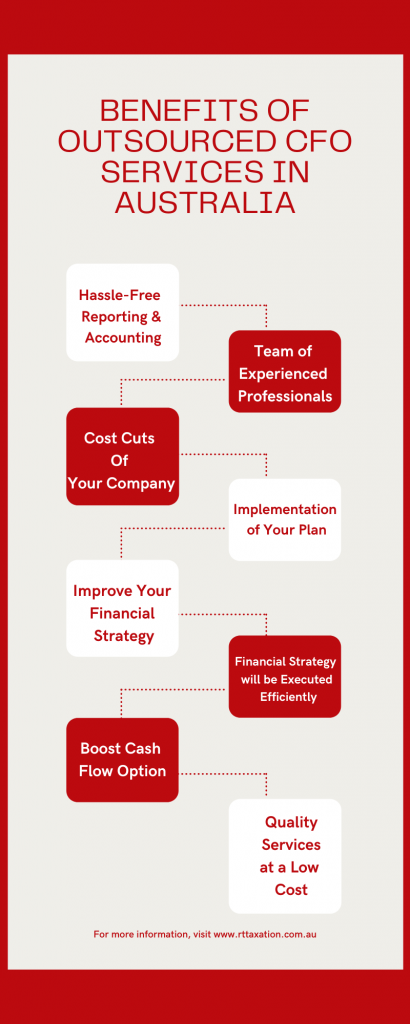

There are many taxations and accounting services provider companies in Australia. RT Taxation & Accounting is one of them. We provide the best taxation, outsourced CFO, Accounting services, etc. So, if you are looking forward to getting the best company for your tax return services in the eastern suburbs, RT Taxation would be the best choice for you.

Why RT Taxation?

- We are experienced in taxation for 10 years.

- Best Tax Return experts

- Affordable service charges

Conclusion

In conclusion, a tax return professional is someone who aids with the filing of state taxes. The role they play varies depending on the state they live in, but there are several that cover all tax returns. The services provided may include filing taxes, giving advice and instruction on how to file, or offering tax preparation services. Some tax return preparers work exclusively for one party and some work for both state tax preparation parties and individuals. All in all, a tax professional is a person who has mastered the art of filing taxes and knows how to reach every individual that may need their assistance.