What is a Self-Managed Super Fund?

Super Fund is a kind of mutual fund, which has been actively managed by the administrator or the manager. Self-managed funds are generally less risky than actively managed funds and have a number of advantages over them. They can be invested in various types of assets, including government bonds, stocks, and so forth. Super Fund Investment Rules lets you know how to invest in Self-managed Funds in the most suitable way.

Self-managed super funds are usually more liquid than actively managed funds. Because of this, the investment options can be explored to a greater extent. These investment plans can also be designed to meet your own requirements. However, there are certain rules that you must observe in order to follow these investment plans. These rules include the amount permitted to be invested, annual income, minimum balance amount, and maximum drawdown amount. The purpose of these rules is to provide investors with a clear idea about the various investment options available to them and to make investment decisions according to their requirements.

The Main Aspect of Self-Managed Super Fund

The most important aspect of any investment plan is that the money should be used for its intended purpose. If the purpose is not fulfilled then there will be no profit from the investment plan. Therefore, if you are planning to make a long-term investment plan then only unqualified securities like bonds, shares, and so on should be included in the portfolio. If you are planning to make a short-term investment then you can include equity instruments like common equity or preferred stock, government bonds, corporate bonds, and so on.

Rules of Self-Managed Super Funds

Invest a Limited Amount of Money in Each Investment Option

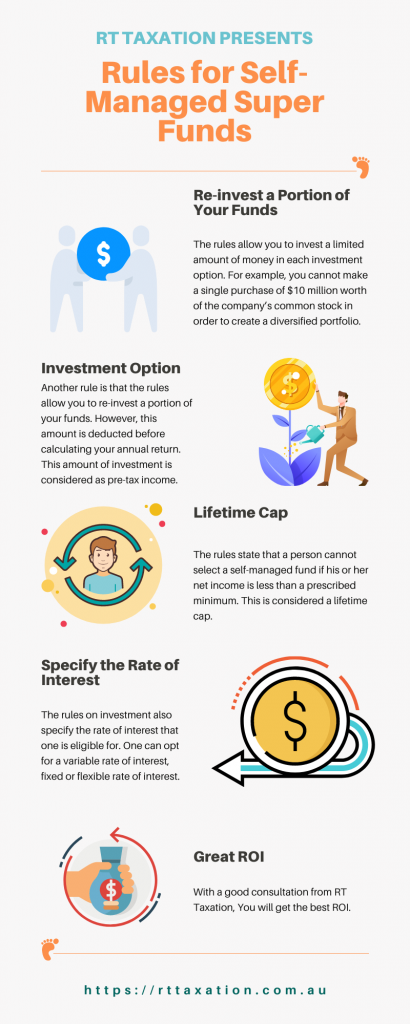

The rules allow you to invest a limited amount of money in each investment option. For example, you cannot make a single purchase of $10 million worth of the company’s common stock in order to create a diversified portfolio. Your portfolio must be selected after considering the risk factor as well as the potential growth of the portfolio. There is an allowance of up to 25% of the total amount invested in each such option. The rules allow you to stop the investment if the conditions do not favor your investment plans.

Allow You to Re-invest a Portion of Your Funds

Another rule is that the rules allow you to re-invest a portion of your funds. However, this amount is deducted before calculating your annual return. This amount of investment is considered as pre-tax income. You are allowed to invest a certain amount of your annual return towards paying off any debts of the fund.

Lifetime Cap

The rules state that a person cannot select a self-managed fund if his or her net income is less than a prescribed minimum. This is considered a lifetime cap. A person who is retired and living on a pension can also make use of the fund. Such a person may also contribute to the fund but his contributions are not subjected to the lifetime limit. This way retirement income is tax-deferred till such time that the investor withdraws from the fund.

Specify the Rate of Interest that One is Eligible For

The rules on investment also specify the rate of interest that one is eligible for. One can opt for a variable rate of interest, fixed or flexible rate of interest. This is necessary so that you know whether your investments are yielding good results. If you opt for an equity mutual fund, it is advisable that you invest small amounts. However, if you choose a balanced fund, you may also opt for higher rates of interest.

Why Do You Need to Consult an Accounting Firm Before Investing?

There are a lot of valid reasons to consult with an accounting firm before investing in a Self-Managed Super Fund. RT Taxation and Accounting is such a firm to guide you in the self-managed super fund’s investment. Then why late? Contact RT Taxation & Accounting for the consultation to get the best return of investment (ROI)

Conclusion

While investing in a self-managed fund, you should remember that the returns depend a lot on your choices and the type of investments you have chosen. These investments are designed to generate high returns. Thus, one should be careful about the type of investments, the rates of interest, and the rules pertaining to the management of the fund. Only after careful consideration should one go ahead with the investment.