Small Business Income Tax Offset

The small business income tax offset (or also referred to as the unincorporated small business income tax offset) may decrease the tax that a company pays by as much as $1,500 per year. The offset is calculated on the amount of tax paid on business income alone. In general, the smaller the business, the more the business will be eligible for the tax break. It is important that you keep all these facts in mind so that you can properly take advantage of the offered tax benefits. In short, the more you can save on your taxes, the more you can invest and thereby increase your wealth.

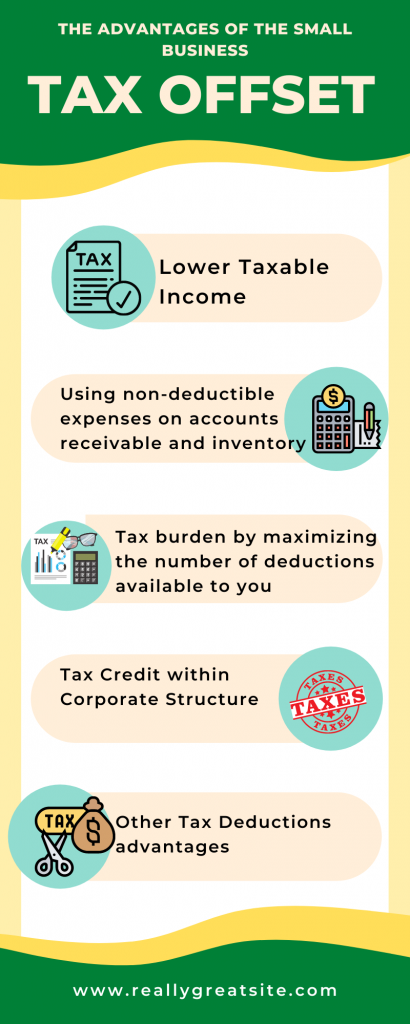

The advantages of the small business tax offset

You may be able to

- lower your taxable income;

- increase your cash flow

- take advantage of special tax breaks

- write-off your interest paid on your investment along with a tax reduction.

Lower Taxable Income

There are several ways by which you can lower your taxable income and/or increase your cash flow. These include:

- Increasing your share of retained earnings

- Increasing the amount of working capital

- Using non-deductible expenses on accounts receivable and inventory

- Reducing the cost of operating overhead

- And reducing your service costs.

Basically, you can avail of a tax reduction if you have more cash than you need to cover your expenses. If your business generates a large part of its income from customers, then you can easily get a tax reduction when selling your goods and services.

Tax Burden

You can further reduce your tax burden by maximizing the number of deductions available to you. These include itemized deductions, standard deductions, and tax credits. You must however understand that these deductions are only available to you if you itemize your deductions, qualify for the itemized deduction, and attain the maximum standard deductions allowed for your filing status.

Tax Credit within Corporate Structure

You can also take advantage of the small business income tax offset by claiming a tax credit within the corporate structure. This means that all profits made by your business as a sole trader will be fully credited as a deduction. Your small business entity can claim up to two personal tax credits within the same year. However, there is a limit of one personal credit per year for sole traders. You can increase this amount by making sure that all of your employees or members in a formal organization or partnership benefit similarly to how their counterparts in a sole trader unit would.

Other Tax Deductions

There are also many other tax deductions available to you as a small business entity. Most of these deductions require an itemized list of expenses and incomes and prove helpful in showing that you spent less than your income to earn your expenses. Some examples of deductions to use at the small business income tax offset include the regular expense deduction, charitable contributions, and state and local taxes, as well as mortgage interest and property taxes. There are many other deductions you can choose from, but they are generally more complicated to understand. It is best to consult a professional before deciding which deductions to use.

What Small Business Income Tax Offset

The small business income tax offset allows you to include interest paid on mortgages, as long as it was not included in your taxable income. You can include dividends received from equity investments, but you need to list the portion of the dividends that were included in your taxable income. Business casualty losses may also be included in your income when applying the offset, depending on the type of loss. Casualty income is not usually included in the offset portion of the deduction; however, you can claim deductions for personal injuries and similar expenses. A casualty loss is any financial loss resulting from theft, destruction, or damage of your vehicle or other property.

Where to Find the Best Taxation Services in Sydney?

If you are looking for the best quality taxation consultant or services provider, then RT Accounting and Taxation will be the perfect company for you. RT taxation has a long experience and professionals in this industry. So, If you are looking for any sort of taxation consultant or business tax return services, Contact RT Taxation.